Overview

According to State statute, a tax sale is a sale of redeemable property claim to a 3rd party. An adjudication is a sale of redeemable property claim to the City. When a tax sale is held, the property itself is not sold, but the taxes are “sold” through a bidding process and a lien is placed on the property for the delinquent property taxes. If there is no bidder, the City becomes the de facto lienholder.

A 3rd party contractor facilitates a yearly tax sale and monthly Sales of Adjudicated Property (SOAP) of delinquent property taxes.

All liens, taxes, interest, and tax sale costs must be paid in full by the final scheduled date of tax sale to be excluded from the sale.

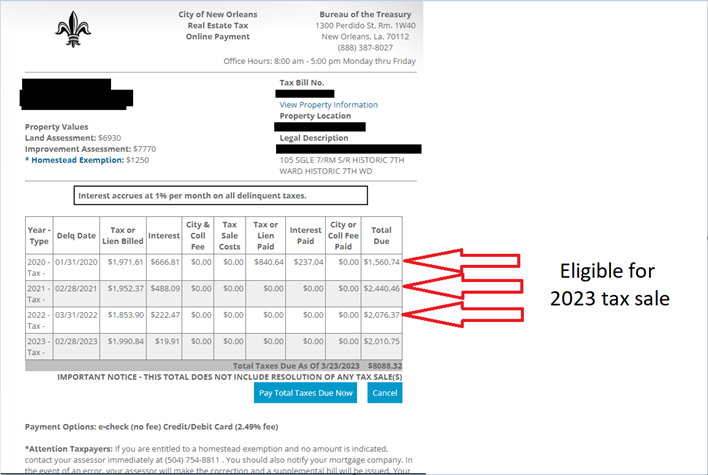

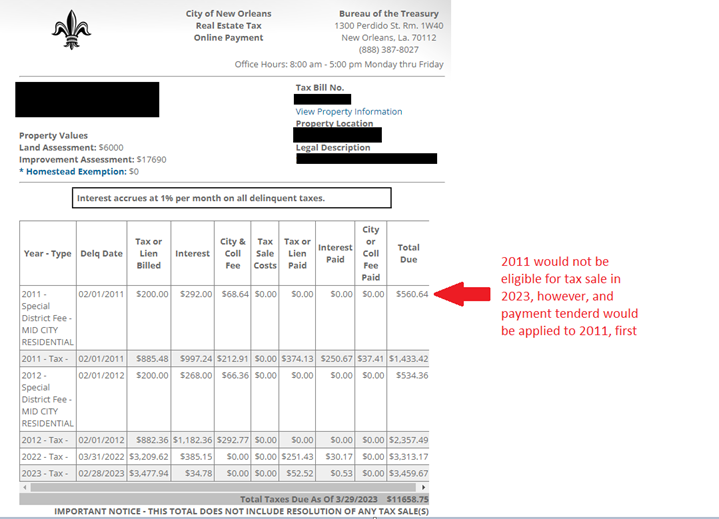

Properties with taxes and liens due for the three prior years are eligible for the current year’s tax sale. (For example, if a property has a tax bill with outstanding taxes for 2008, 2020, 2021, 2022, 2023, only the taxes for years 2020, 2021, and 2022 will be eligible for the 2023 Tax Sale.)

Payments made for properties involved in a tax sale will be applied to the oldest delinquent debt, excluding Code Enforcement Liens, if the property has a homestead exemption. If there is no homestead exemption, payments will be applied to liens first, then the oldest delinquent debt. (i.e. Property has outstanding taxes due for 2008, 2020, 2021, 2022, and 2023. Any payment made will first be applied to year 2008, then 2020, 2021, 2022, and lastly 2023.

Redemptions

Properties with a tax sale claim must be redeemed. To redeem, a taxpayer must pay:

- The amount paid by the tax sale purchaser during the tax sale

- Interest of 1% per month until redeemed

- 5% penalty

- Current year’s taxes and other indebtedness

A redemption results in the property claim of tax sale or adjudication being removed.

Generally, for tax sales, the redemption period is 3 years from the date the tax sale certificate is recorded. A valid blight judgement reduces the redemption period to 18 months. For adjudications, the redemption period can range from 3-5 years from the date the lien certificate was recorded.

A tax sale beyond the statutory 3-year redemptive period becomes a civil matter between the property owner and the tax sale purchaser and legal counsel is advisable. Tax sale purchaser information is available upon request by contacting the Redemption Unit.

An unresolved adjudication to the City can result in property loss at auction at a Sale of Adjudicated Property.

Sale Of Adjudicated Property (SOAP)

Adjudicated properties that are not redeemed during the redemptive period may be eligible for sale. Once a property is sold during a SOAP sale, it is no longer eligible for redemption.

Find properties for sale

To find out if a property will be sold through a Tax Sale or an Adjudication Sale, contact CivicSource at: